MBA Dividend Income Portfolio

Link to Fact Sheet

Link to back test

Link to Commentary

Link to MBA page

Link to homepage

The MBA Dividend Income Portfolio seeks to deliver a rising dividend yield at least 50% higher than the S&P 500 yield, combined with dividend growth and total returns comparable to the S&P 500 Total Return Index, but with lower volatility and reduced Beta over full market cycles.

Portfolio Composition & Mechanics:

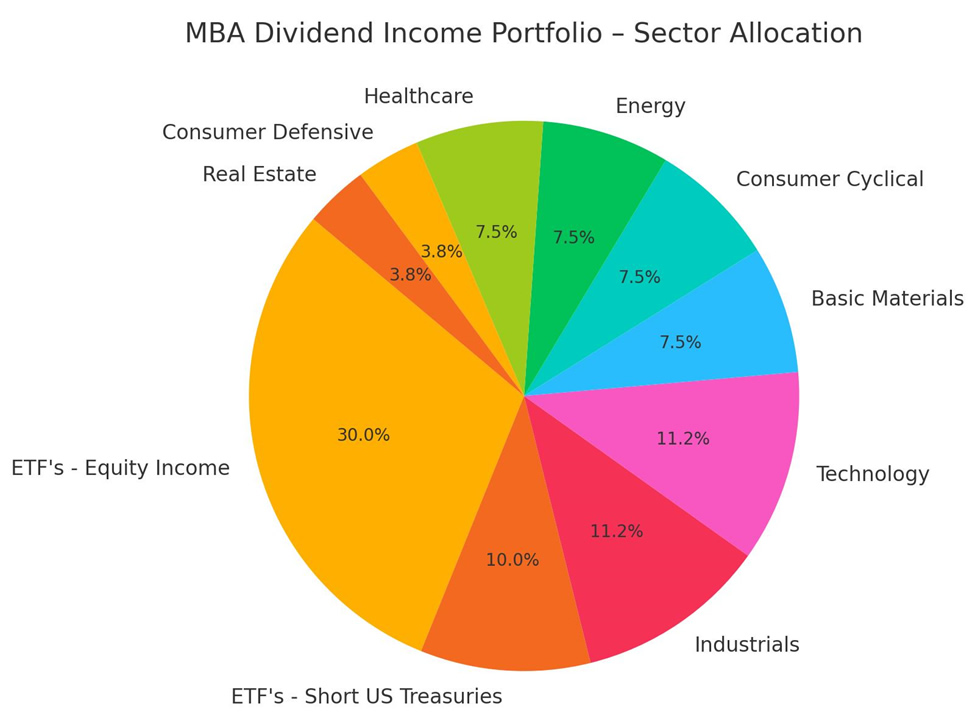

- 40% U.S. Dividend Equity ETFs (currently SCHD)

- 60% Individual Dividend-Paying Stocks diversified across industries

Individual stock selection emphasizes:

- Dividend yields ≥ 150% of the S&P 500 yield

- Dividend growth rates (3-yr) at or above the S&P 500 growth rate

- Relative strength (3-yr) ≥ 1.00 vs. S&P 500

- Beta (3-yr) typically below 1

- Consistent historical dividend increases

- Industry and sector diversification

Portfolio Management & Rebalancing:

- Long-term holding of individual stocks for tax-efficient qualified dividends; no active trading of these individual positions.

- ETF holdings are tactically managed using Managed Beta Allocation (MBA) proprietary signals to potentially enhance returns and manage risk.

- Rebalancing occurs opportunistically, typically when individual holdings exceed 5% of the total portfolio, mandatory at 6%, or upon position replacements. Full-portfolio rebalancing occurs in response to primary trend-signal changes affecting both ETF and individual stock allocations.

- New client investments are allocated according to the previous calendar quarter-end model allocation.

Removal Criteria for Holdings:

- Significant dividend reductions

- Strategic sector reallocation

Current Holdings Summary (as of April 1, 2025)

Take the Next Step in Your Investment Journey

Sign up for our newsletter or schedule a consultation to discover how CPR PRO INVEST can help you optimize your investments. Stay informed with the latest strategies and insights tailored to your financial goals.